Debt information

Since July 2022, Fugro has a new comprehensive sustainability-linked financing with extended maturities in place.

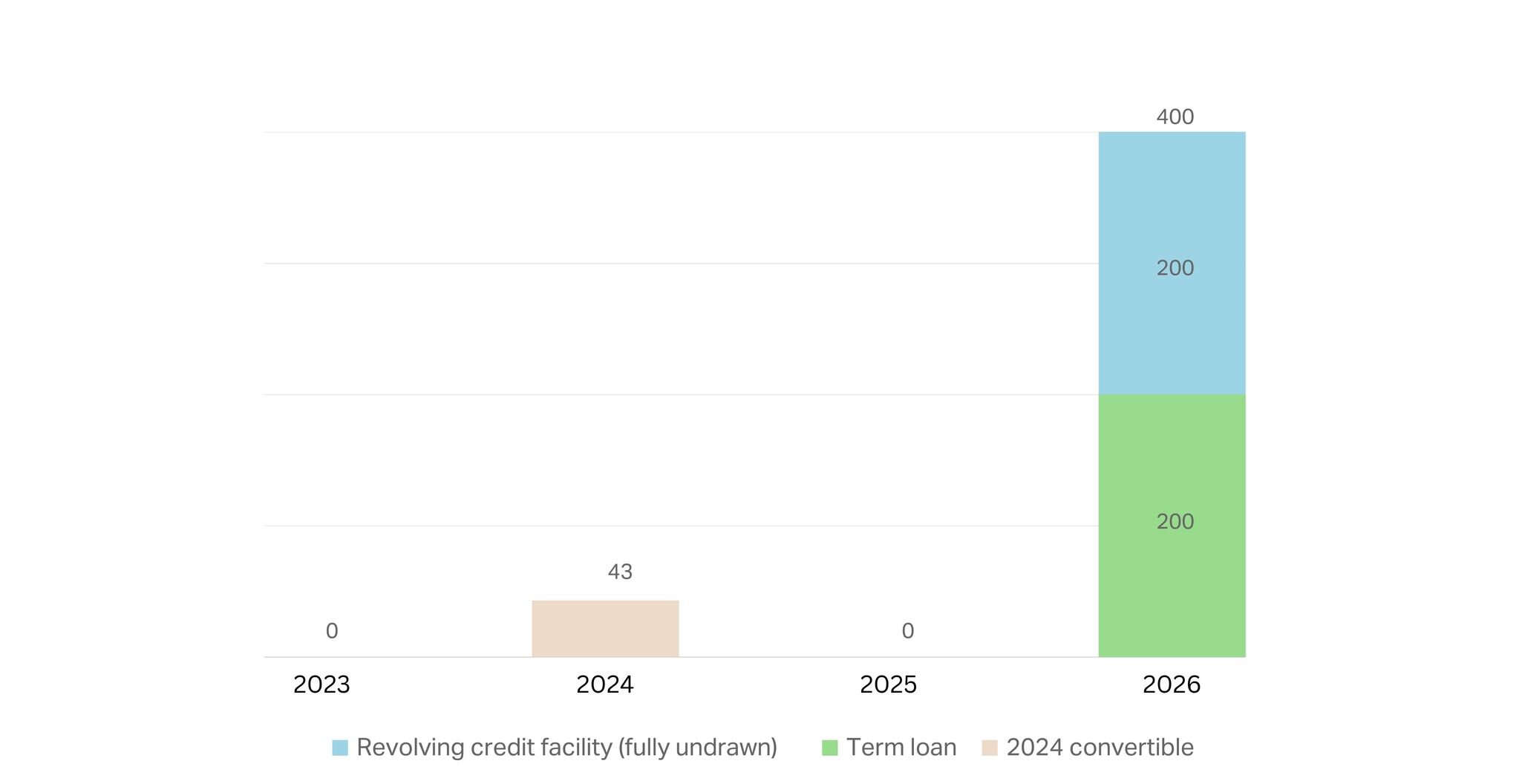

Maturity profile per July 2023

in EUR million

Bank facilities

We have a EUR 200 million 3-year senior secured sustainability-linked revolving credit facility and a EUR 200 million 3-year senior secured sustainability-linked term loan in place, both subject to a 1-year extension option, with six relationship banks.

The initial rate of interest on the revolving credit facility is EURIBOR +2.75% and depending on leverage can vary between EURIBOR +1.75% and EURIBOR +3.75%. To date, this facility is fully undrawn. The term loan has an initial interest rate of EURIBOR +3.50% and depending on leverage can vary between EURIBOR +3.25% and EURIBOR +5.00%. A discount or penalty of between 5 basis points and 10 basis points will be applied on the margin payable on the revolving credit facility and the term loan based on the performance of Fugro against specified targets for three key performance indicators as outlined in the sustainability-linked financing framework.

2024 convertible bonds

These bonds carry a coupon of 4.5% and a conversion price of EUR 19.6490 (as per 21 December 2020).

The bonds are trading on the Open Market (Freiverkehr) segment of the Frankfurt Stock Exchange (symbol: ISIN: XS1711989928).

Of the original EUR 100 million nominal value outstanding, we have repurchased EUR 57 million in principal amount.

Sustainability-linked financing framework

Our sustainability-linked financing framework in place. This confirms our strong commitment to our ambitious sustainability targets.